Field notes - Edition #10

Ruble and sanctions, HDFC, Twitter, European markets, Debt, Citi bank, SPACs

Welcome to the tenth edition of the Field notes! 📘

This is your weekly go-to place to get a gist of everything interesting I come across in blogs, newsletters and podcasts. Curated reads and podcasts basically. ✍️

What an interesting journey for Ruble. Did someone say sanctions?

If you are a Fintech startup helping people with savings, investments and managing money or if you are a climate startup working on sustainable and scalable solutions, Rainmatter can be of help with capital and incubation. Please do reach out to me at dinesh.pai@rainmatter.com. 🤙🏻

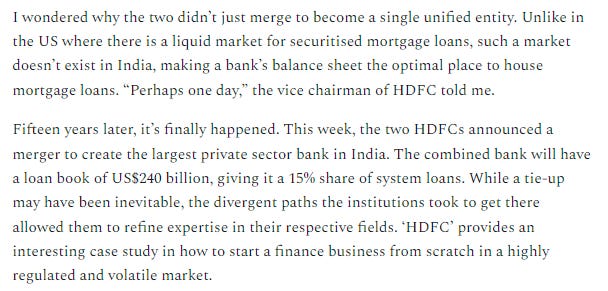

HDFC and HDFC Bank have merged - the single entity now will enjoy diversified credit books and also lower cost of funds across the board. Mortgage loans have helped HDFC be the behemoth it is today, but the merger would help take this further. And also perhaps create more value for the shareholders. Read more here -

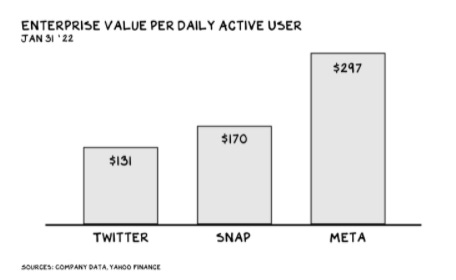

Changes at Twitter - Elon Musk now owns a 9% stake. Read more about this here, which explains more than just the stake and what might just be going on in Elon’s mind -

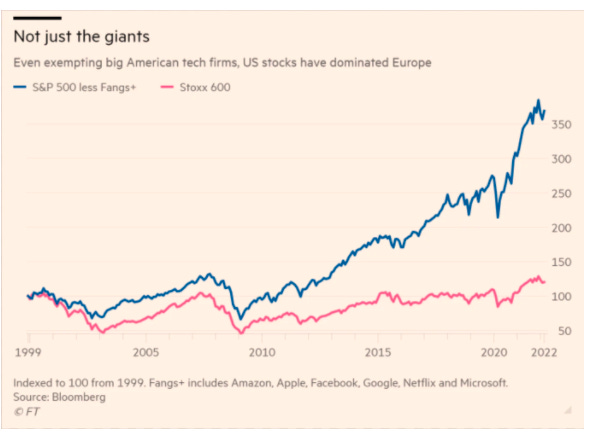

We have not really spoken about Europe specifically with capital market performance on Field notes. Was reading this piece on how Europe has lagged the US significantly over the past few years.

Macroeconomics, and lagging technological development aside, I don’t think there are political majorities to be had in Europe for the kind of pro-business policies that would be necessary to unleash a US-style equity boom.

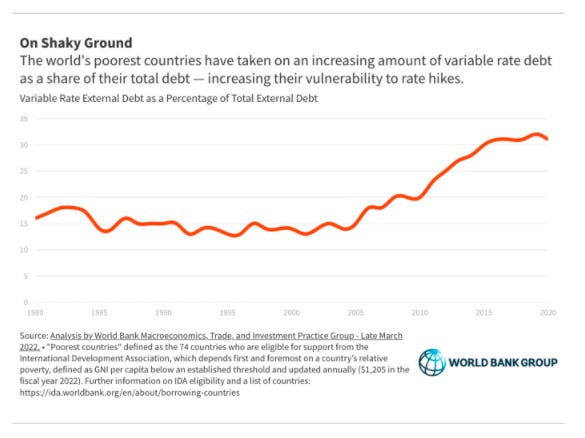

And from the same newsletter - a piece on increasing debt amongst emerging markets around the globe, and why an intervention is imminent. Where it will come from, time will tell -

Axis bank in India is buying Citi Bank’s retail banking division for USD 1.6 billion. Lots of it owing to Citi’s focus elsewhere, given that its retail division was profitable. More here and here -

Axis bank on the other hand has a lot to gain. Their credit card business hasn’t set the world on fire. With the Citibank acquisition, they get access to another 2.5 million credit card users who on average spend 50% more than their own clientele. These are premium customers.

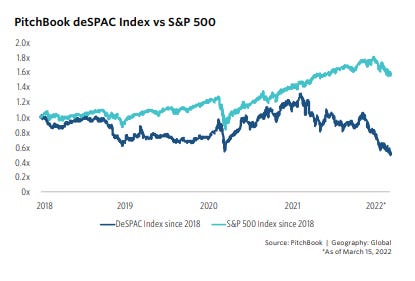

Weaponizing USD - has it set in motion the imminent rise of other reserve currencies? Or at least the availability of alternatives? Read more here -

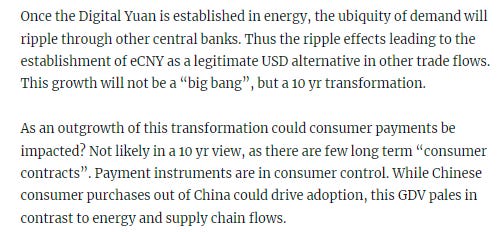

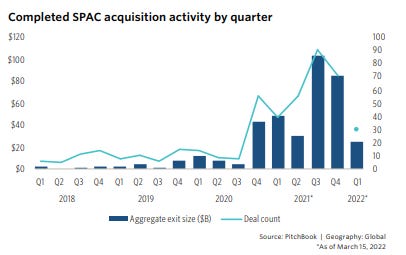

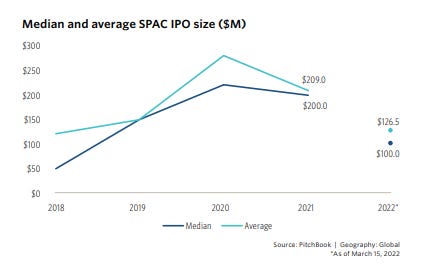

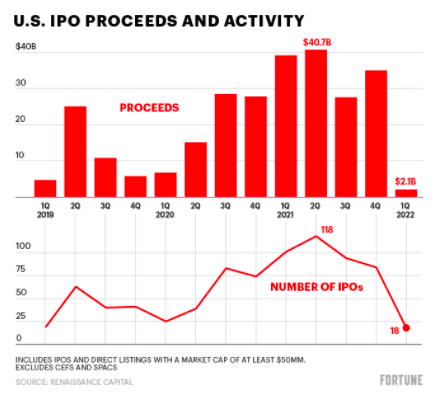

Some interesting stats on SPACmania,

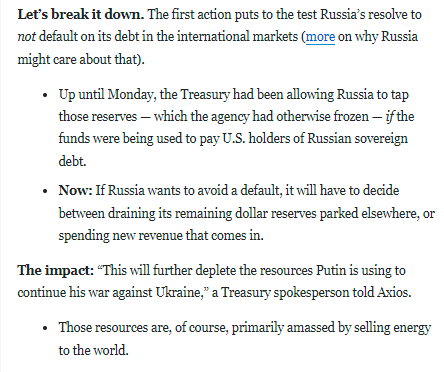

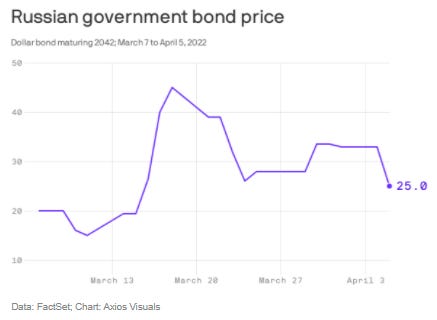

Russia might be heading to debt default. We spoke in previous editions about how, so far, the US has been allowing some of the banks to process debt coupon payments through dollars from Russian oil sales to Europe. But that seems to be coming to a halt from this week. Interesting times ahead -

Bond markets reacted,

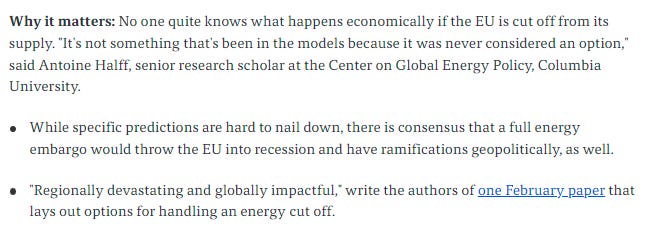

Pressure increases on Europe to move away from Russian dependency. No surprises here, however, the idea is now gathering more steam and could potentially be beneficial for Europe in the longer run, and in the shorter run, it will cause some pain to European countries. Read more here -

Stats on IPO Activity in the US

Some interesting tweet threads -

Podcast for the week -

Please do share what you found useful and also let me know bits that you dint like too much. Please do tell all your fintech and market enthusiast friends about Field notes and the friendly neighbourhood Paisan (that’s me!). 🖖

Stay safe everyone and have a great weekend.