Field notes - Edition #11

Twitter, JP Morgan, Goldman Sachs, Sequoia, Asset allocation, Inflation and asset allocation, Greece

Welcome to the eleventh edition of the Field notes! 📘

This is your weekly go-to place to get a gist of everything interesting I come across in blogs, newsletters and podcasts. Curated reads and podcasts basically. ✍️

If you are a Fintech startup helping people with savings, investments and managing money or if you are a climate startup working on sustainable and scalable solutions, Rainmatter can be of help with capital and incubation. Please do reach out to me at dinesh.pai@rainmatter.com. 🤙🏻

JP Morgan is undoubtedly one of the important institutions in the financial world. And Jamie Dimon is probably one of the most important banker of our time. And Jamie’s annual letter is always directed by almost everyone. But here is a succinct summary of what he said in the annual letter. He dint hold back about the competition that is ahead with all the fintech startup revolution and has shared how JP Morgan as an institution is ready to step up and do what’s necessary to survive -

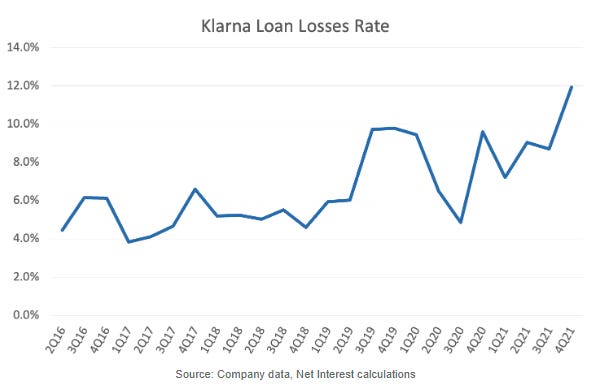

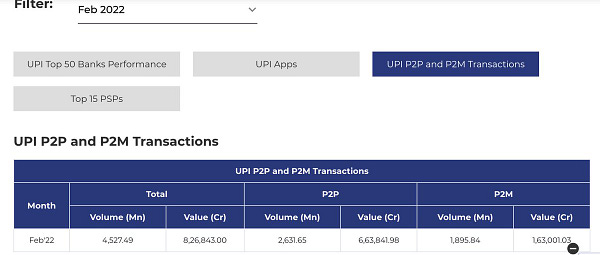

Net Interest newsletter shared some of the premium content teaser this week. Very interesting bits in this piece including Goldman Sachs, BNPL (Klarna), and Sequoia, must read -

Check out this simple post on what you should be doing with your portfolio in an environment where rates are rising. The short answer is to diversify into asset classes that probably will have lower drawdowns - so essentially diversify into fixed income, commodity apart from just equity. Some historical analysis on various asset class performance during rising interest rates here -

And a very simple strategy to think about investing with all the noise around - read this piece to understand how 200 day MA can help as a signal for when to stay invested, and this applies to amy index (with reasonable research of course of past drawdowns) -

Well, where Elon goes, frenzy follows. Don’t get me wrong - SpaceX, Tesla are just amazing businesses and brilliant execution examples. As much as success is about ideas, execution matters more when you are aiming for a moonshot. And Elon is all about execution. And Twitter has been in the news the past couple of weeks because of - no guesses needed - Elon. But if you still want a gist, read this and this.

And a poison pill may be in the offing after all. Who knows.

Check out the SEC filing,

Not going to elaborate any more on this as a lot has been written, and unless you have been living under a rock, you probably know the sequence of events. But I found this really nice piece on competition, anti-trust and fairness by Scott Galloway. Read more here -

We discussed inflation almost in all editions of Field notes. A lot of factors acting as a perfect storm - Ukraine-Russia Conflict, supply constraints, buying spree, commodity price fluctuations. Read more here -

And you must be asking, will this inflation last? This read says most of this will have to do with what happens with China over the next few months. And if you think the fed rate hikes will prove to be the saviour, this chart below is shouting out that we should temper our expectations -

And from the same newsletter - read this in case you are curious about why gas prices are rising in the US. Supply, demand, capital discipline, Russia - so many factors at play. Very nice summary in this piece.

A really nice piece on the state of economy in Greece. It feels like yesterday that we were reading about the debt crisis, and for now, seems like Greece is doing quite well,

On April 4 2022 the Greek government announced that it had repaid the last of the 28 billion euros that the IMF had provided in funding in 2010 and 2014. 1.9 billion euros were still outstanding and they were the most expensive debts on Greece’s books. By paying off the IMF, Greece saved 230 million euros in debt service costs.

Was speaking to a friend about predictions and how futile predictions are without understanding history. Ray Dalio has been one of the proponents of how history shapes everything and he also suggests history does repeat more often than not. Found this really nice piece from Morgan Housel on predictions by understanding root causes (or deep roots) -

And a piece from same blog on staying put. This article was quite informative and all the young folks should definitely read. :) The benefits of compounding in life or investments can only be seen looking backwards.

Some shorter takes -

Twitter threads for the week -

Podcast for the week -

https://charlierose.com/videos/31221 (Unfortunately, there is no thumbnail, but great listen)