Field notes - Edition #3

Economic cycles, data analysis, rising rates and effect on banks, VC, Metaverse, CBDC, Stablecoins, Tiger Global

Welcome to the third edition of the Field notes! 📘

This is your weekly go-to place to get a gist of everything interesting I come across in blogs, newsletters and podcasts. Curated reads and podcasts basically. ✍️

Hope you guys enjoy it. :)

If you are a Fintech startup helping people with savings, investments and managing money or if you are a climate startup working on sustainable and scalable solutions, Rainmatter can be of help with capital and incubation. Please do reach out to me at dinesh.pai@rainmatter.com. 🤙🏻

Podcast for the week -

Let’s get started with one of the key takeaways for me over the past few months of going over data for unemployment, economic recovery, income statistics etc has been to critically look at some of the underlying models being used and metrics being employed. Here is a great read on how employment numbers can be made to look good with a few quirks -

If there is one essay on banks you should read this week, its this one by Net Interest. There has been a lot written about how the Fed is planning to raise interest rates, in a bid to soak up liquidity. And commentary on what that means for bond markets also has been written extensively. The impact of he rate hike for banks is also quite interesting, and the interest rate risk management is detailed quite well. Read more here -

A short read on some of the factors that have helped emerging geos attract VC capital. Most of these are well-known reasons by now if you have been following this space. But this is a really good take with specific reasons why in the US the VC capital is not restricted to old school VC hubs. Read more here -

Been hearing a lot about CBDC’s and stablecoins for the past few months. One thing is for certain, banks need to be prepared to offer rails to facilitate CBDC or stablecoin transactions. They also need to be prepared to reconcile these assets accurately. Read more here -

While we are speaking of stablecoins, here is a nice read -

And if you need some more commentary on this subject, read this -

Bailouts are probably more common than we think, and everyone is probably preparing for a stablecoin bailout too. Read more here -

Regulations are needed. A recent report from the President's Working Group on Financial Markets asked Congress for regulation and said "failure to act risks growth of payment stablecoins without adequate protection for users, the financial system, and the broader economy."

As much as we would all love to attribute all of our success to hard work and individual ability, there are always bigger things at play. Luck is probably the most important thing for anyone to be successful. Read why here -

Afghanistan as an economy is facing several challenges. It is becoming increasingly more likely that without aid, the situation is just going to get worse. Here is a nice piece on the way forward -

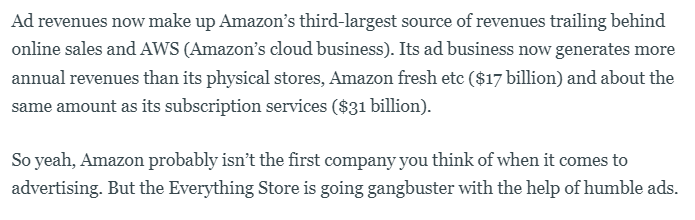

If you are in the business of selling products (e-commerce or otherwise), advertising is the natural extension to business operations. As more and more sellers would want to be first in line for listings, inventory and catalogue, ad revenues go up proportionally. As a result, we are seeing Amazon also killing it with the ad business. Read more here -

The company earned $9.7 billion in advertising revenues in the fourth quarter of 2021, i.e. a 32% year-on-year gain. For the whole of last year, Amazon made some $31 billion in ad revenues. This is bigger than the ad revenues of YouTube. It is bigger than the ad revenues of the entire global newspaper industry. It is big even for Amazon’s high standards.

With almost 7 billion USD invested in India this past year, it certainly was the year of the Tiger 🐯. I am not going to bore you with details, but here is a gist if you have not been following the VC world. Tiger Global is not a conventional VC player and they have lived up to that reputation last year. They pumped in billions in VC investments last year, clocking multi-million dollar rounds every week. And usually, when Tiger chooses to invest in a startup, competitors of the startup almost are resigned to the fact of what is going to happen (..killing softly, with money of course..). Read here -

While we are talking about venture capital, here is a nice read on Power Law -

US inflation shows no signs of tapering. Labour shortages, increased fiscal spending, supply chain issues, and low interest rates have led to this situation. This is after Fed indicated rate increases this year. Will we see inflation rise further? Time will tell. But this must be a lesson to all central banks printing money, that there is no easy way out if you opt for modern monetary theory. Read here -

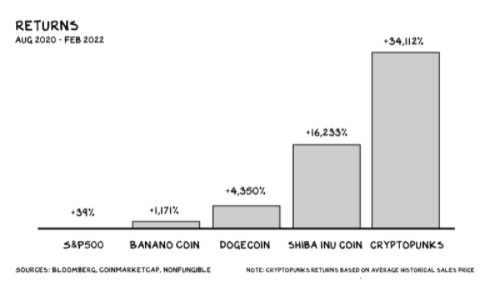

We have all heard about NFT’s (… let’s not even go there. Am going to stick my neck out and say it’s a well-crafted scheme..). But non-fungible people is a nice concept. For everyone out there building businesses, this is a great read -

Metaverse anyone? There is a lot of content floating around about digital identity and what social media interactions will look like in the future. There are investors betting on this being reality, and there are certain underlying arguments that are worth noting. Read more -

While we are talking about the metaverse - here is a great read on how you should be thinking about investing in this space. Read here -

As much as we would all like to talk about asset classes, one of the major considerations with wealth and freedom is time. This is a great read on why it is important to be mindful about how we spend time -

On a related note, here is a good read on managing and leaving behind wealth -

Interesting charts from this past week -

Longer reads -

Tweet of the week -

Please do share what you found useful and also let me know bits that you dint like too much. Please do tell all your fintech and market enthusiast friends about Field notes and the friendly neighbourhood Paisan. 🖖