Field notes - Edition #7

Commodities trading and Nickel, Nuclear energy, ESG, Term insurance

Go well, Shane. 🏏

Welcome to the seventh edition of the Field notes! 📘

This is your weekly go-to place to get a gist of everything interesting I come across in blogs, newsletters and podcasts. Curated reads and podcasts basically. ✍️

If you are a Fintech startup helping people with savings, investments and managing money or if you are a climate startup working on sustainable and scalable solutions, Rainmatter can be of help with capital and incubation. Please do reach out to me at dinesh.pai@rainmatter.com. 🤙🏻

A strange sequence of events at the London Metal Exchange (LME).

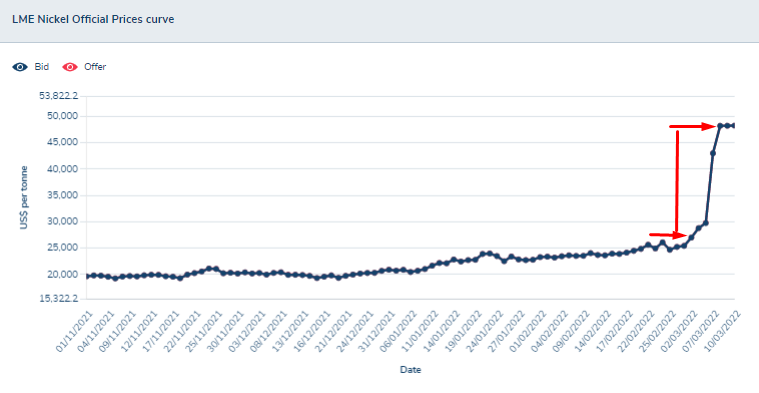

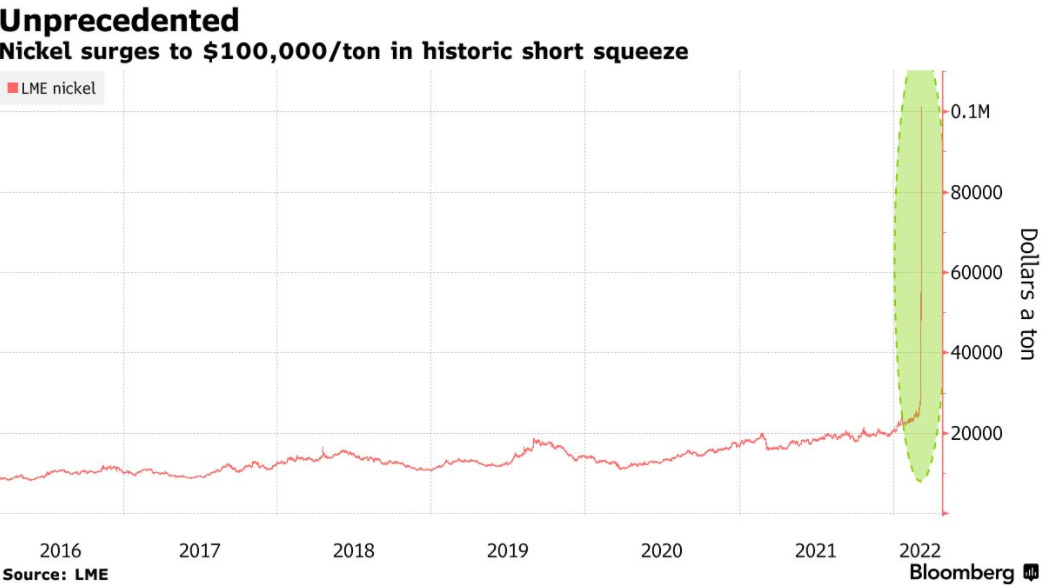

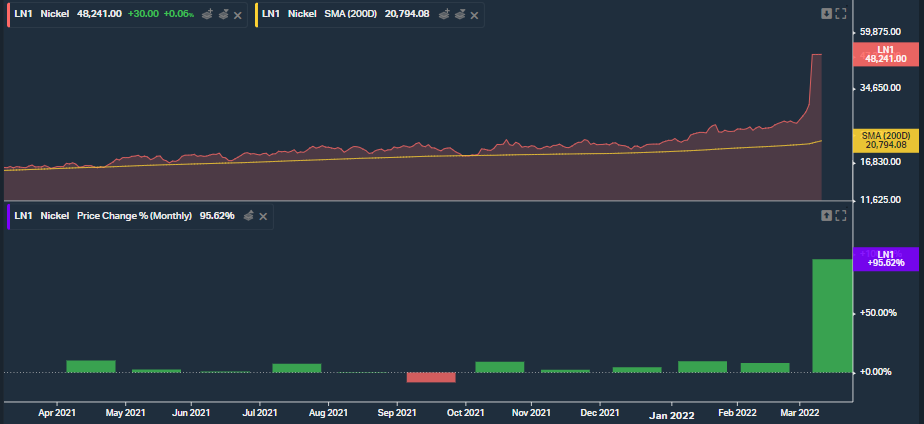

The London Metal Exchange suspended the nickel market early Tuesday this week, the first time it had paused trading in a metal contract since the collapse of an international tin cartel in 1985. The decision followed a near doubling in prices over a few hours—a run-up traders said had no precedent.

And this is why,

..Chinese nickel titan Tsingshan Holding Group, sitting on $8 billion in trading losses, said Wednesday it had secured enough metal to settle all its loss-making positions, according to a state-run media outlet.

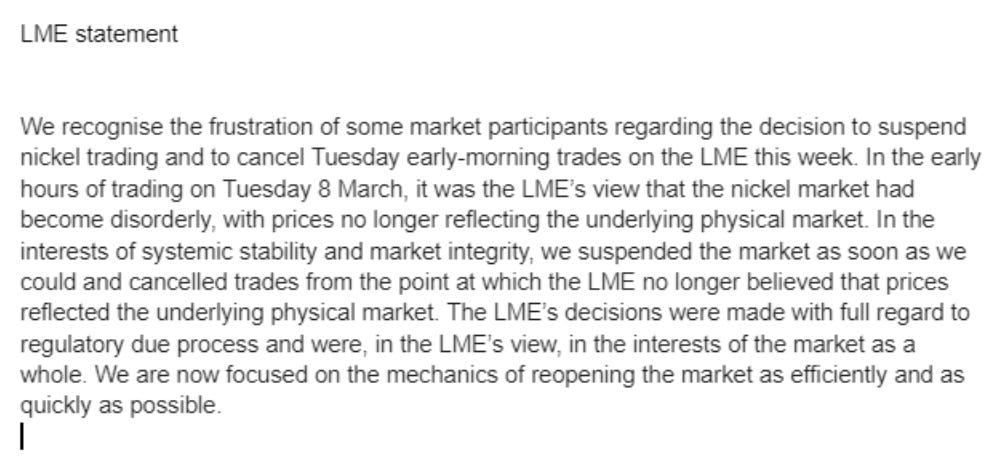

And here is the note from LME when it halted Nickel trading on Tuesday,

LME today announced that the trading of Nickel will be suspended for Friday (12th March). The following note was on the LME website,

Classic short squeeze in play. But this demonstrates the risk and volatility of commodities trading. Nonetheless, it forms a very significant portion of trades that happen globally.

All this is quite unprecedented, and I was just wasting time on Twitter looking for some interesting stories and came across this Twitter thread, quite fun -

TL;DR,

Because the Hong Kong Exchange OWNS the London Metals Exchange, and guess who owns HKEX? First letter is a C third letter is a P won't tell you the middle one, the HKEX owning the LME just shut down all metals trading in nickel so that a Chinese company didn't blow up ..

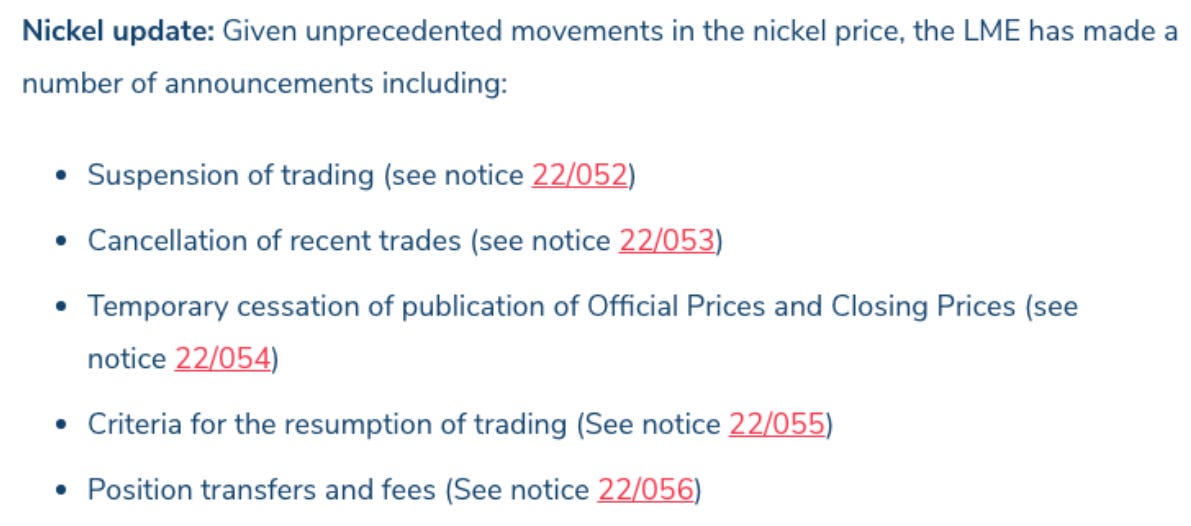

There were cancelled trades too,

All this begs the question - what does this do to the credibility of LME. We will probably find answers by tracking commodity tading volumes over the next few months. Will write again about this in a couple of months.

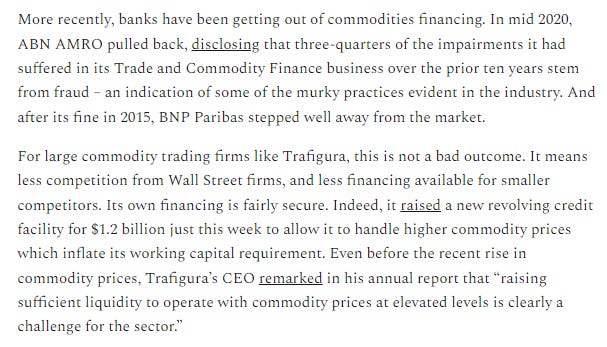

While we are speaking of commodity trading, found this really nice piece on what’s happening in this space. Read more here -

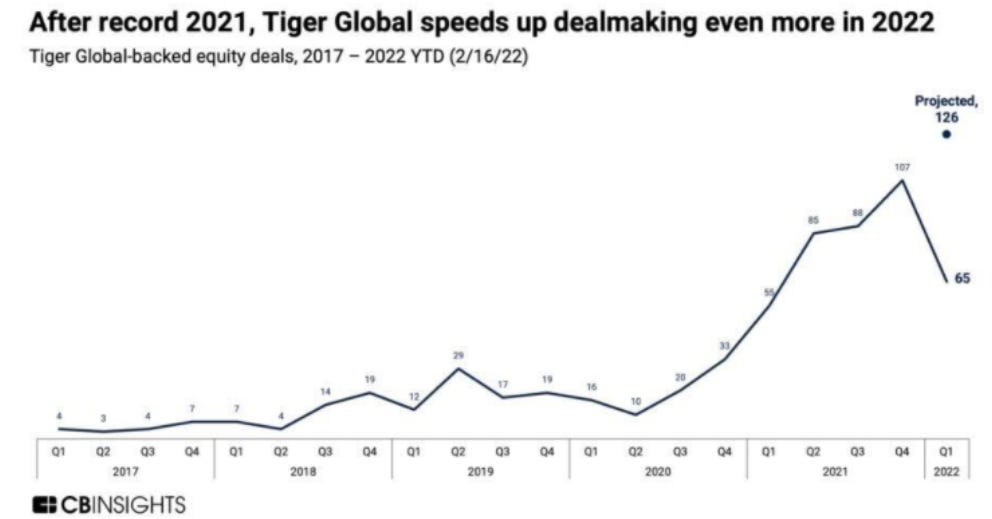

Tiger keeps going and has committed to $1 Billion for early-stage tech investing -

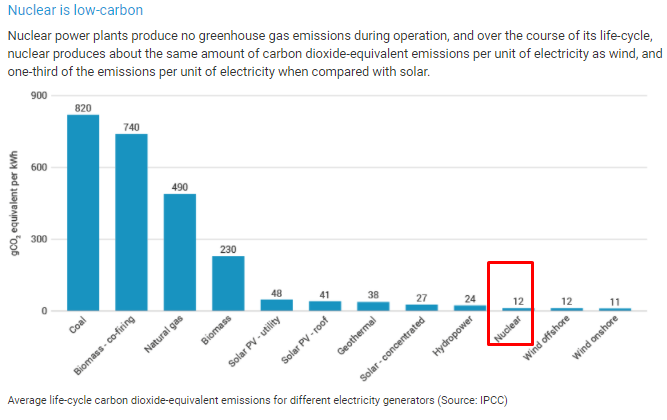

A lot of noise around nuclear warheads this past week thanks to the Russia-NATO conflict. But in the climate change context, Nuclear energy is in several ways better than conventional forms of energy.

Some very interesting graphs in this piece,

Have been following US investments in the nuclear energy space, and are these signs of things to happen in India too? Indian climate investments lag the US by a few months. Check out this investment announcement by USV -

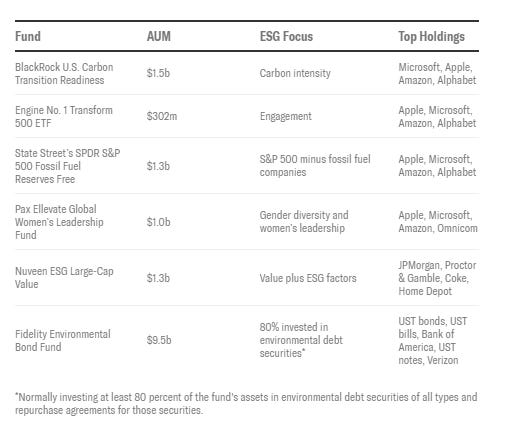

ESG as an investment class is picking up - a lot of greenwashing is on the rise as well. A lot of optics involved and some problems with the entire ESG reporting structure. A lot of funds and companies are probably not abiding by the textbook definition of ESG - leaving more on the table. It has become quite convoluted. Read more here -

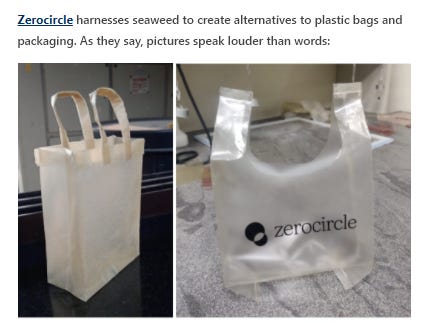

Check out Zerocircle -

A podcast you should listen to -

And do read this piece by Ditto on insurance.

Please do share what you found useful and also let me know bits that you dint like too much. Please do tell all your fintech and market enthusiast friends about Field notes and the friendly neighbourhood Paisan (that’s me!). 🖖

Stay safe everyone and have a great weekend.