Field notes - Edition #9

Chinese markets, behavioral finance, VC bust?, LBO, Vanguard, LME

Welcome to the ninth edition of the Field notes! 📘

This is your weekly go-to place to get a gist of everything interesting I come across in blogs, newsletters and podcasts. Curated reads and podcasts basically. ✍️

Read more about Chinese economy here.

Was unable to publish this last week, hence combining all the content from the past two weeks in this edition. :)

I am a sports buff, so I can’t really not add a bit of sports content in this newsletter.

An end of an era perhaps. Dhoni has handed over the captaincy of CSK. For a sports personality, there is always one moment that defines everything about them and for me, it is the 2011 World Cup. Can anyone forget the winning six? Certainly not.

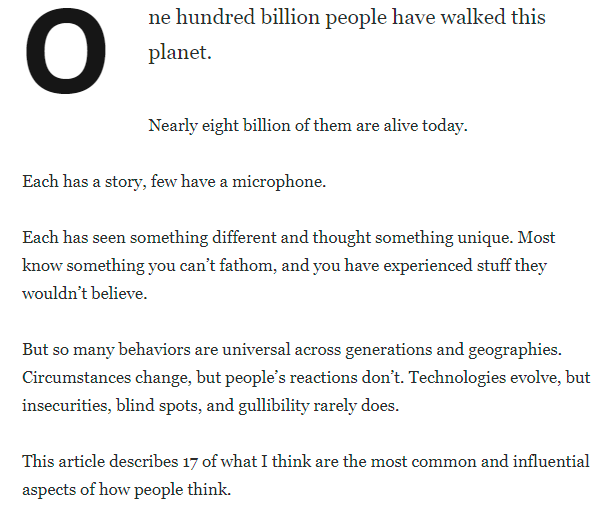

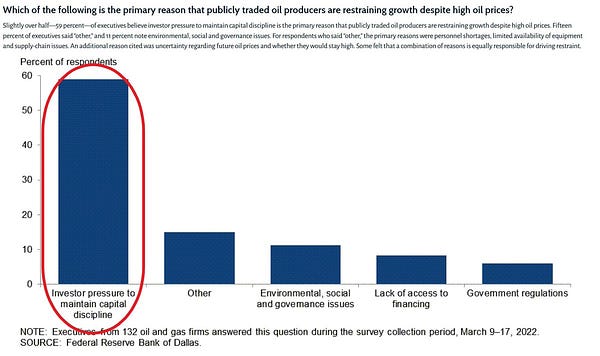

Must read piece from Morgan Housel on human behavior -

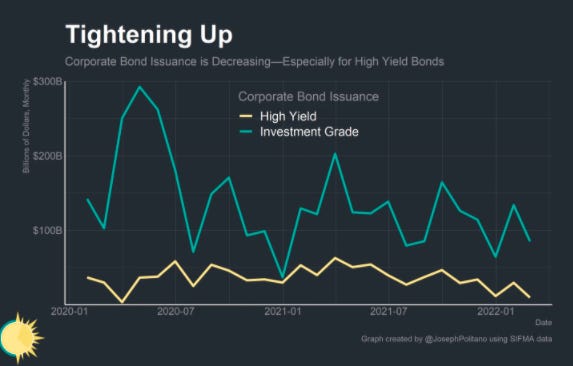

Had shared some pieces on the Fed rate hikes in the previous edition. A lot of rumblings continued these past two weeks as well. In simple terms, as prices go up due to inflation, central banks try to limit the flow of money in circulation by increasing rates and making it difficult for everyone to borrow money. COVID + Ukraine-Russia conflict + Supply chain constraints has all led to supply side impact on prices. And at the same time there has been crazy amount of luquidity, meaning too much money chasing too few goods. Unless productivity increases, both supply and demand has played a part in price hikes. But I personally feel, the supply side of the equation has been the major reason, and rate hikes might not really help tackle inflation.

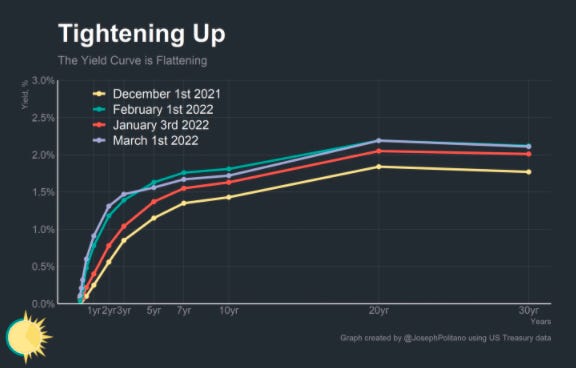

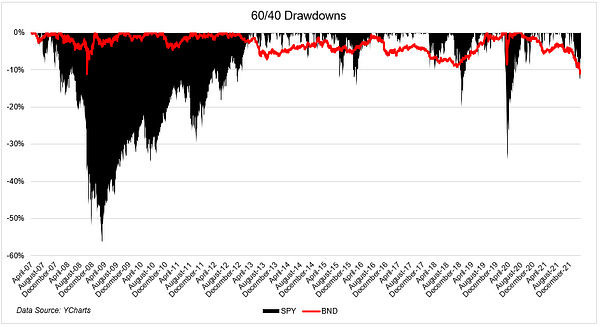

Found another nice piece on the fed rate hikes. The piece also talks about a flattening yield curve, which since then has inverted slightly, professing the imminent arrival of a recession. However, sharing a piece below the graphs on why inverted yield curves might not really be a signalling for recession, given how in the past not all instances of inversion led to recessions -

Here is the piece on why inversion of yield curves might not be bad at all -

In a recent working paper, Eugene Fama and Kenneth French found that using inverted yield curves to predict recessions proved bad financial advice: 67 of 72 global term spread strategies underperformed passive equity investing. That’s partially because the yield curve has a worse predictive track record outside the US, failing to predict any Italian recessions while littering Canada and the UK with false positives. That’s also partially because the yield curve gives off shifting signals: the 2s10s spread went negative in early 2006 before bouncing back by mid 2007, way before the 2008 financial crisis reached its worse. There’s also always some degree of backtesting bias in terms strategies: with so many different spreads to choose from and a relatively small sample of recessions, there will always be one spread that looks like a good recession predictor by pure happenstance.

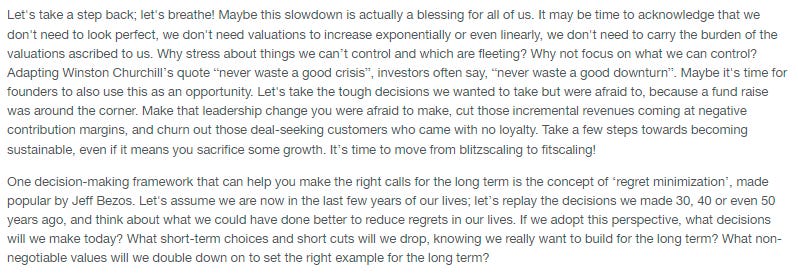

VC firms have had a great time splurging for the past two years. Music seems to be slowing down. It appears that firms are now focused on profitability and creation of value rather than chasing lofty valuations and funding rounds. Some of the IPOs of tech stocks have had terrible results the past few weeks across the world, and that seems to have tempered expectations for private market enthusiasts too. Investors are now conscious of profitability, revenue models, monetization, user retention, rather than just user growth. Here is a nice piece that ties it all together and speaks about how founders should think about in these crazy times -

And cracks are showing I suppose -

Report from Bain on the VC space in India -

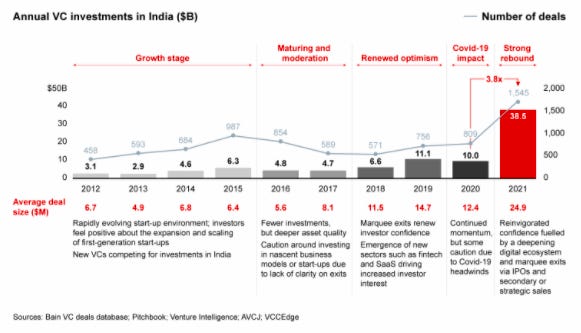

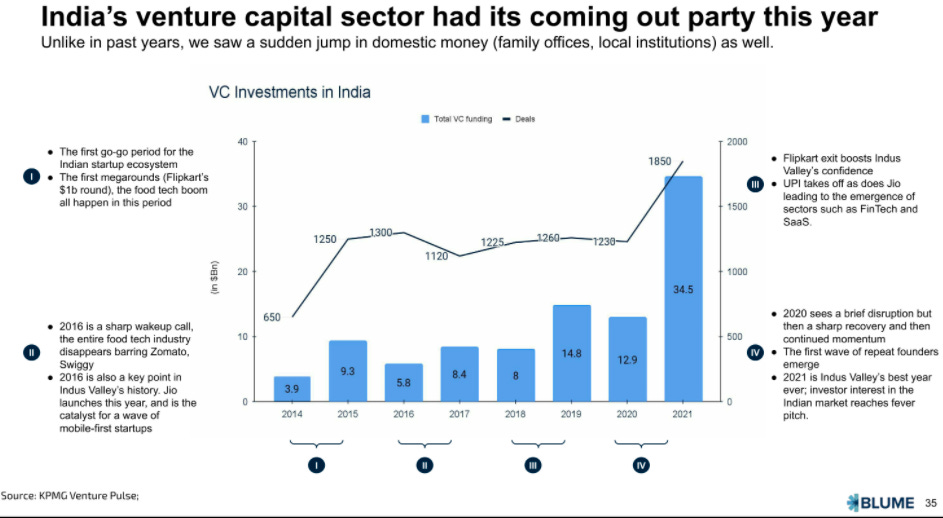

And a really nice detailed view into Indian startup ecosystem by Blume -

TL;DR? -

UPI penetration - 40% of POS digital transactions (more than credit cards and debit cards in FY 2020)

50% of ecommerce transactions still in cash - How come “cash is king” even with digital payments roaring? 1 (Finshots wrote about this long back too)

Lower women laborforce participation and lack of quality engineers

1 GB of data now costs 6 rs instead of ~260 in 2014

Contribution of IT to Indian GDP, and startups also creating value - India is 4th largest county by size of venture funding

Market share between traditional brokerages to discount brokerages - 64% vs 36%

Digital lending is 6% of retail loan book

SaaS along with Fintech did really well last couple of years in terms of funding and user growth

Internet access, UPI, Public digital infrastruture, access to cellphones are the reason why Indian startup ecosystem has taken off

The document states India’s per capital GDP as 2000USD, but a there is growing segment of population with 4000USD per capita income

VC funding deals and amount increased multifold - 35 billion in 1850 deals in 2021, increasing from 12.9 billion in 1250 deals in 2020

Tech IPO’s increased from 2% to 35% in dollar value - but except ease my trip, all tech stocks have seen drops

9x spikes in ESOP buybacks amounting to 440 million USD in 2021, was 50 million in 2020

Amazon sells more ads than The Times of India

Rainmatter features in this deck too on page 90

BNPL to grow faster than credit cards

Lot happening in the markets and a lot of pieces on how predicting market movements is tricky. Read this really good piece on optimism, or the lack of it -

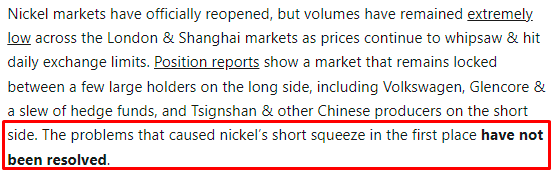

Nice updates on LME (we’ve spoken about this in previous editions) here -

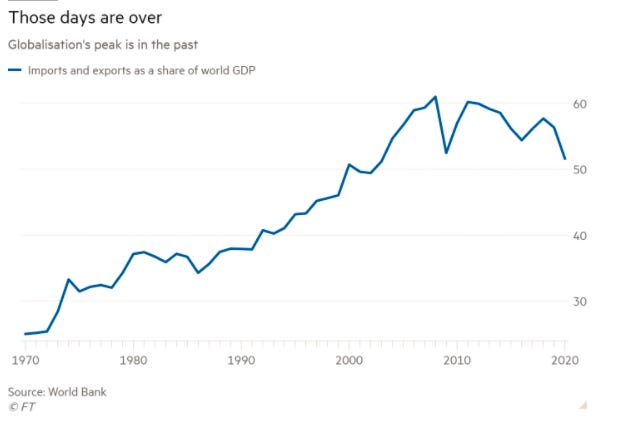

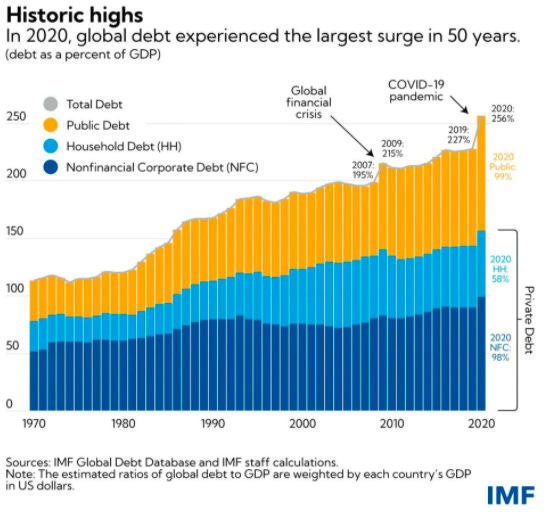

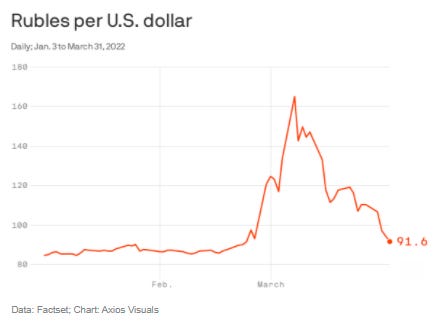

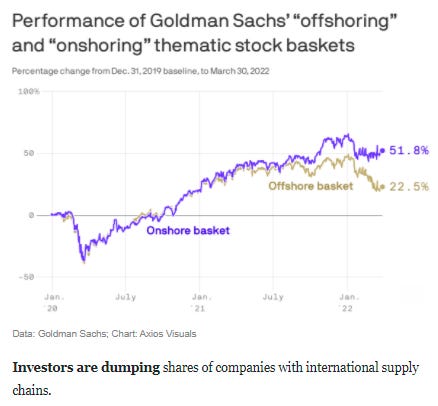

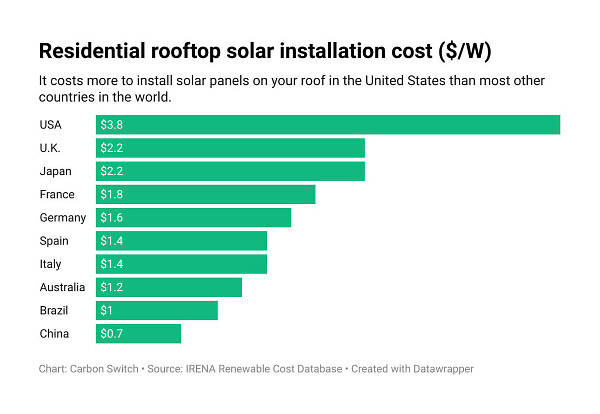

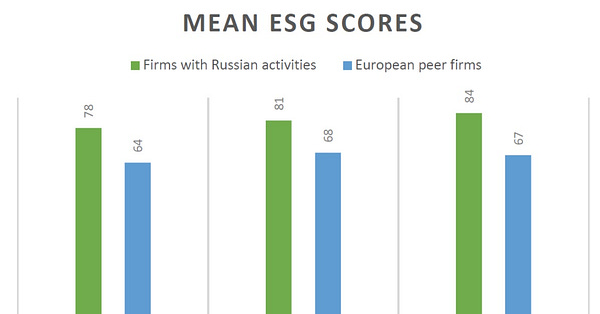

End of Globalization? Quite a nice read on all that is happening on the global economic front. The couple of graphs tell quite a story.

Have seen a few pieces on psychology recently. Not related to fintech, but still worth a read. Read this piece on how to think about ambitions -

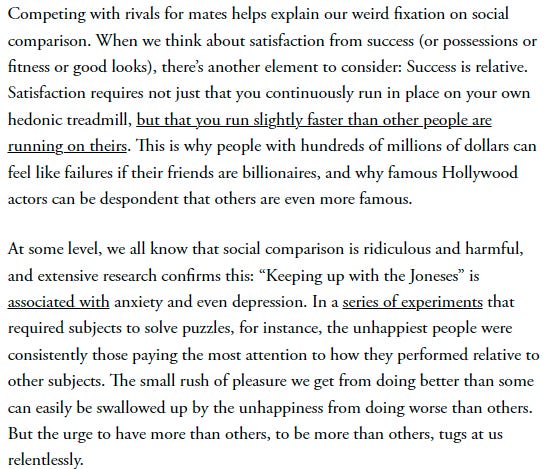

Another nice read on how to think about personal status and what should be the north star when thinking about what you would like to specialize in or be known for -

Though the pursuit of status is a hard temptation to fight off, there is a simple way to prevent it from controlling you—play multiple status games at once. Instead of linking your entire identity to a single status game (i.e. richest, smartest, etc.), have multiple things going for you. In other words, diversify what brings you status.

An amazing read on how to want less in life. That sums it up I guess -

Check out this other piece on how to think about second order effects with decisions you make on a daily basis. Basically, ‘watch what you wish for’ -

The shorthand here is pretty simple. The world is now blowing up in all sorts of unexpected ways because we’ve put artificially rigid structures on natural systems. Businesses or individuals that want to survive need to mimic nature. I believe these patterns are universal and relevant, so learning about them now is a very good use of time (see article below).

If you seek control, prepare to sacrifice life. If you seek life, prepare to sacrifice control. The trick, as always, is getting the balance of control, with a permanent tilt towards life.

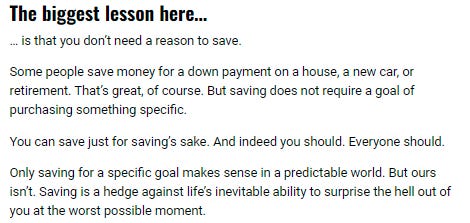

Why should you think about savings a little differently?

A nice read on why leveraged loans are a risky asset class and how these loans can lead to financial instability -

..there is a real risk that in a future crisis the leveraged loan market could freeze up, grinding one of the most significant credit-creation engines in the US economy to a halt. This has the staff of the Federal Reserve Bank of New York worried. The second paragraph of the staff report reads, “We find empirical evidence suggesting that loan funds, which are key credit providers in the leveraged lending market, are much more vulnerable to run risk than any other category of debt mutual funds. Building on the institutional features of their asset holdings, we further document the role of monetary policy as a coordinating factor driving loan funds’ investor flows and their volatility, suggesting a novel channel of monetary policy transmission.”

Podcast of the week -

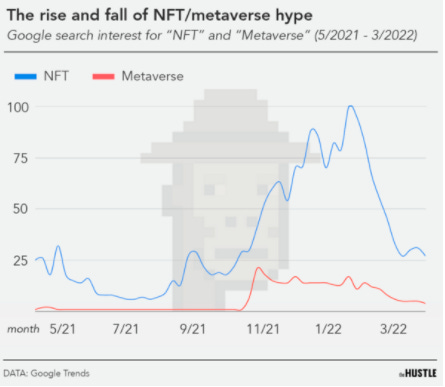

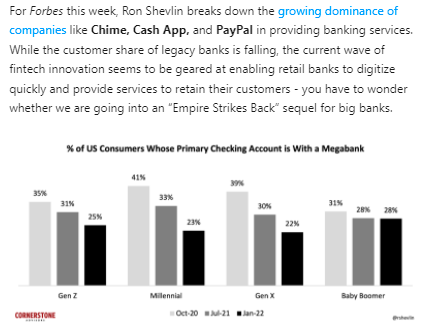

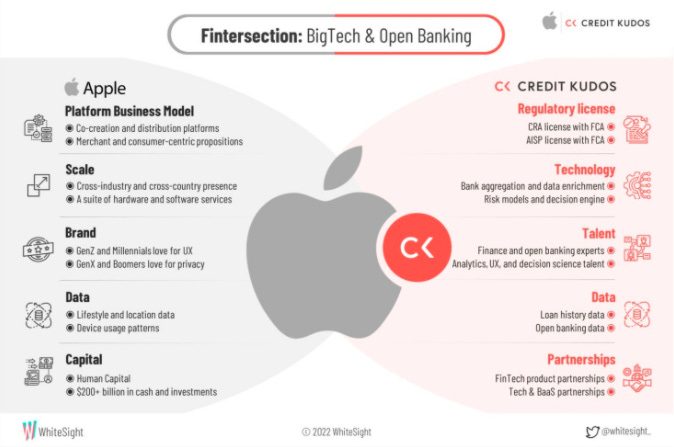

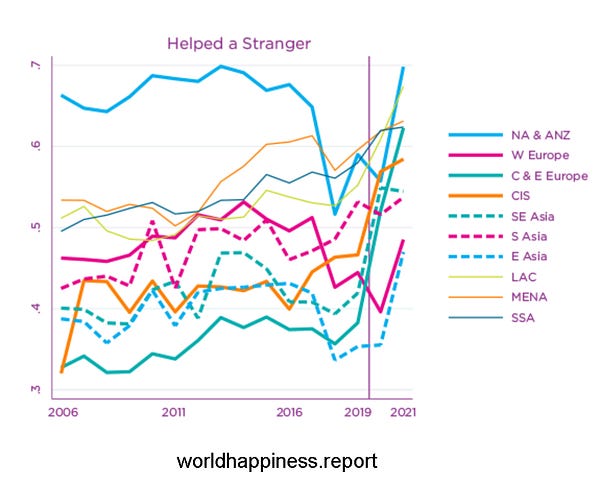

Interesting graphs -

Interesting twitter threads -

Please do share what you found useful and also let me know bits that you dint like too much. Please do tell all your fintech and market enthusiast friends about Field notes and the friendly neighbourhood Paisan (that’s me!). 🖖

Stay safe everyone and have a great weekend.